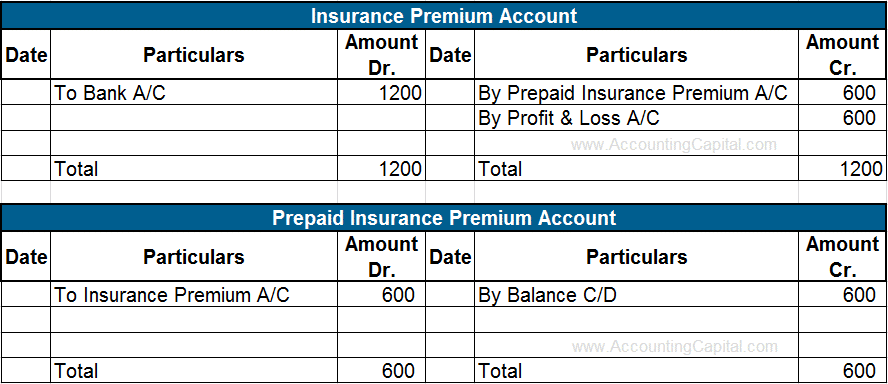

This records the prepayment as an asset on the company’s balance sheet. When there is a payment that represents a prepayment of an expense, a prepaid account, such as Prepaid Insurance, is debited and the cash account is credited. As future invoices come in, the company would recognize an expense and draw down the prepaid asset by the same amount.

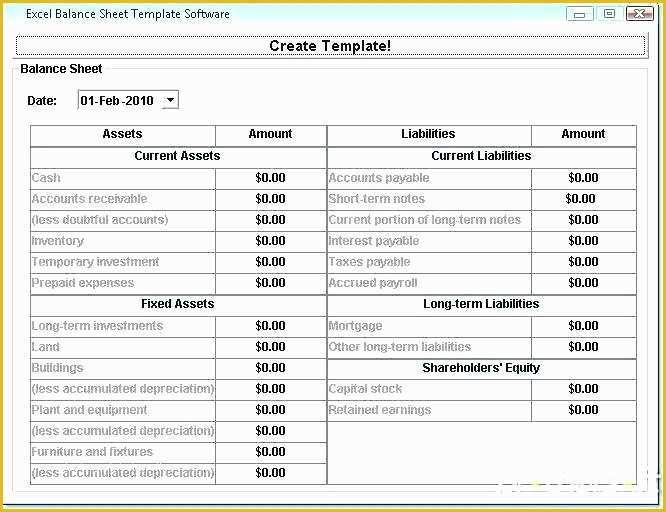

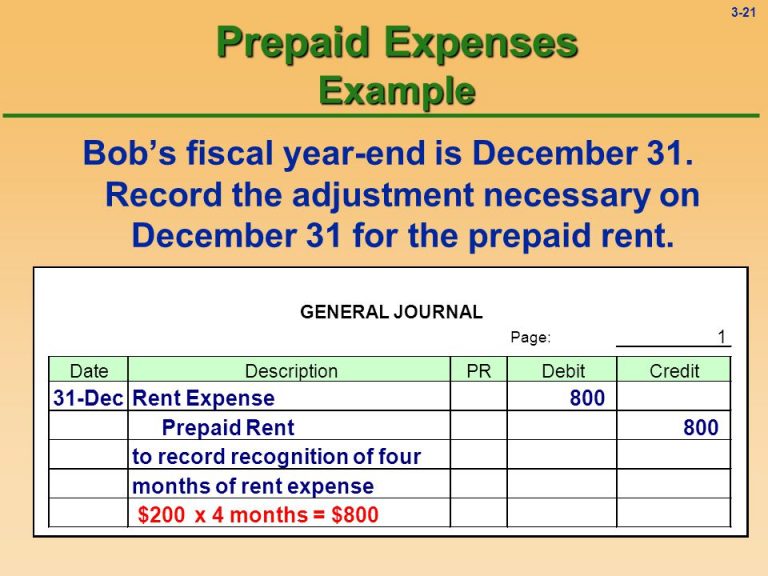

It’s not expensed immediately because the company has not yet benefited from the services. When a company pays a retainer, it is recorded as a prepaid expense on the balance sheet. Retainer for Legal ServicesĪ legal retainer is often required before a lawyer or firm will begin representation. Prepaid rent is an asset because the prepaid amount can be used in the future to reduce rent expense when incurred. An organization makes a cash payment to the leasing company, but the rent expense has not yet been incurred, so the company must record the prepaid rent. Prepaid rent-a lease payment made for a future period-is another common example of a prepaid expense. In each month of the 12-month policy, the company would recognize an expense of $1,000 and draw down the prepaid asset by this same amount. If a company pays $12,000 for an insurance policy that covers the next 12 months, then it would record a current asset of $12,000 at the time of payment to represent this prepaid amount. Insurance is an excellent example of a prepaid expense, as it is always paid for in advance. Here are three common examples of prepaid expenses. No insurance company would sell insurance that covers a past event, so insurance expenses must be prepaid by businesses. For example, the purpose of insurance is to buy proactive protection for the future. Examples of Prepaid Expensesīecause of how certain goods and services are sold, most companies will have one or more prepaid expenses. Once expenses incur, the prepaid asset account is reduced, and an entry is made to the expense account on the income statement. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months). Where Do Prepaid Expenses Appear on the Balance Sheet? Prepaid expenses are not initially recorded on the income statement because according to the Generally Accepted Accounting Principles (GAAP) matching principle, expenses cannot be recorded on the income statement before they incur. Prepaid expenses are considered a current asset because they are expected to be consumed, used, or exhausted through standard business operations with one year.Īs the benefits of the prepaid expense are realized, it is recognized on the income statement. Prepaid expenses are recorded first on the balance sheet-in the prepaid asset account-because it represents a future benefit due to the business. The expense is then transferred to the profit and loss statement for the period during which the company uses up the accrual. With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule. This allocation is represented as a prepayment in a current account on the balance sheet of the company. Prepaid expense amortization is the method of accounting for the consumption of a prepaid expense over time.

There may also be tax benefits concerning prepaid expenses, however, all organizations must follow the proper rules related to tax deductions. Prepaid expenses may also provide a benefit to a business by relieving the obligation of payment for future accounting periods. Sometimes, businesses prepay expenses because they can receive a discount for prepayment. What Are the Benefits of Prepaid Expenses? As the benefits of the good or service are realized over time, the asset's value is decreased, and the amount is expensed to the income statement.

The business records a prepaid expense as an asset on the balance sheet because it represents a future benefit due to the business. Prepaid expenses usually relate to the purchase of something, such as rent or insurance, that provides value to the business over several accounting periods (often six months or a year). Prepaid expenses are considered current assets because they are amounts paid in advance by a business in exchange for goods or services to be delivered in the future. As the benefits of the assets are realized over time, the amount is then recorded as an expense. On the balance sheet, prepaid expenses are first recorded as an asset. Prepaid expenses are future expenses that are paid in advance, such as rent or insurance.

0 kommentar(er)

0 kommentar(er)